A cap on high-potency is far from low-risk

Reporting of a leaked German position paper from the Ministry of Health has revealed a proposal to cap the THC content of legal cannabis at 15%. We lay out why we think a 15% THC cap is highly misguided, and would be likely to hamper the legal industry in converting illicit market consumers.

What has been proposed?

Plans for Germany’s upcoming recreational cannabis market were leaked to German news agency RND on 19th October, originating from the Ministry of Health and its SDP minister, Karl Lauterbach.

The proposals in the leaked document would limit the permitted potency of finished products to 15% THC for those over 21, and 10% for adults aged 18-21. Other controversial plans include a ban on advertising and branding, alongside a limit of 2 plants for home cultivation and a 20g possession limit.

The leaked document does not represent the official view of Germany's coalition government, and has already attracted blowback from coalition members. Regardless of how closely the draft mirrors the view of all government parties, it revealed a point of contention in the industry around whether THC limits should be placed on recreational products in new legal markets.

Politicians are no stranger to using leaks as a political tool to gauge public opinion on controversial policy measures, and the proposals set out in the leaked paper have certainly attracted conflicting opinions. The final ‘position paper’ promised by the government is still set to be released later this year - and as such, proposals are likely to shift.

In committing to a pathway to cannabis legalisation, the German government aims to protect health outcomes and ensure public safety. But with the proposed THC cap, there’s a high risk that the government will be defeated on their own terms.

We lay out why we think a cap set at this level is highly misguided and set to hamper the legal industry’s efforts to convert illicit market consumers. While we resoundingly agree that THC content is not the only driver behind a high quality consumer experience, this restriction reaches far beyond personal consumption preferences.

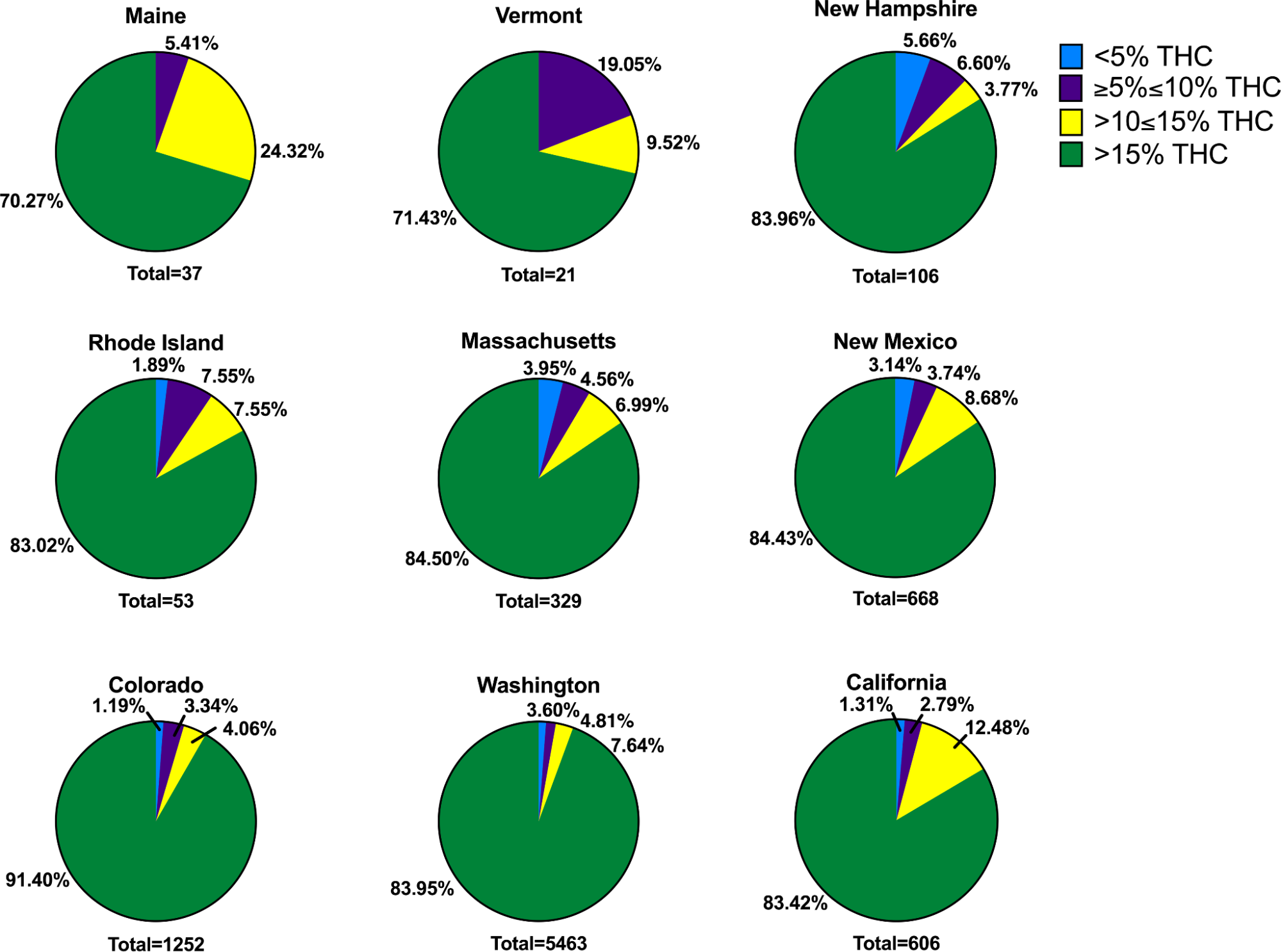

>15% THC cannabis dominates in legal recreational and medical markets:

There is clear and comprehensive evidence that when given the choice, legal cannabis users will select cannabis products with more than 15% THC. In European medical markets, high-THC cannabis similarly dominates the flower category, and a review of global datasets indicates that this is the case across both recreational and medical markets.

US: A 2020 study funded by anesthesiology researchers provides a sector-independent source of data for the potency of products being consumed in legal US markets. Cash et al reviewed THC content in dried flower products across 10 legal US medical and recreational programmes, accounting for 8,505 cannabis products available across 653 dispensaries.

Varieties with >15% THC accounted for between 70-90%+ of all products available per state.

The average THC concentration advertised online in recreational programs was 21.5%, compared to 19.2% in medicinal programs.

Under the leaked German proposals, none of the products in the green wedges of the figure below would be permitted under the legal system.

Figure: Proportion of products available per state based on THC content

Source: Cash et al (Mapping cannabis potency in medical and recreational programs in the United States, 2020)

Figure: Frequency of products in relation to their THC content across US states

State-level differences in the availability of high-THC products indicate that external factors also play a role in this variation / influencing consumer purchasing decisions.

Canada: The same picture is painted in Canada. Data from the Ontario Cannabis Store (OCS), the province’s state-run monopoly wholesaler and the sole provider of online cannabis sales, provides a strong basis for analysis.

A Hanway review of the OCS online portal revealed that varieties with >15% THC accounted for 93% of available whole dried flower SKUs, with <15% THC representing just 32 out of 461 products in the category.

Products on the OCS are advertised with a THC range of up to +/ - 3%, to allow for variability between product batches (for example, a 17% THC flower can have an advertised range of 14% - 20% THC). Taking this into account, a further 13 of the 32 products in the categories above would be excluded from the German system due to their upper range exceeding 15%.

That means only 4% of whole dried flower SKUs available in Ontario would be permitted for sale under the leaked German plans. Ambitions to bring the best of legal North American genetics to Europe become infeasible if the majority of these varieties would be prohibited.

Figure: Number of whole dried flower products available on the Ontario Cannabis Store (OCS) in October 2022 by THC content

Source: Hanway analysis of whole dried flower products available on the Ontario Cannabis Store online portal in October 2022

2. Alienating exactly the wrong base:

Capping legal products at 15% would alienate heavy cannabis consumers the most, as they are responsible for the bulk of consumption of higher potency products.

Intensive consumers make up just 11% of Germany’s cannabis consumer base according to EMCDDA data, while being responsible for 78% of total resin consumption and 67% of total flower consumption.

Restricting potency to 15% would do more harm than good by disincentivizing much of this group from engaging in the legal system. This group should be the exact group of people that policy seeks to reduce harm to, given that:

The risks of cannabis consumption are thought to be exacerbated by intensity of use

This group is typically highly stigmatised, and may be reluctant to engage with public health interventions

This group of consumers is at the most at risk of criminalisation due to increased interactions with the illicit market or home grow

In the words of the State of Vermont’s Cannabis Control Board, ’high THC cannabis makes up the majority of products sold in the medical cannabis and illicit marketplaces. Lowering the THC cap to 15% [from 30%] would merely perpetuate the unregulated market and force consumers to purchase untested, potentially contaminated products’.

Figure: Estimated number of cannabis consumers in Germany by intensity of consumption with the respective percentage of total flower and resin consumption represented by these groups

Source: Hanway analysis of EMCDDA data (Estimating the size of the main illicit retail drug markets in Europe: an update, December 2019)

The evidence base indicates that alongside heavy consumers, young people are at increased risk from the harms associated with cannabis consumption. While it is reassuring that the leaked proposals aim to address and mitigate these harms, imposing a separate limit of 10% THC for this group could reduce the benefit of these measures.

Decisions around the age requirement for legal cannabis consumption have long been contentious, given that brain development continues until around the age of 25. Young people represent a strong subset of cannabis consumers and have a prominent influence on cannabis culture as a whole. Of the estimated 3 million European daily cannabis users, roughly 70% are aged between 15 and 34, with much of this group believed to fall on the earlier side of that range.

Would a legal market where 18-21 year olds could only purchase ‘low-dose’ 10% THC products appeal to them more than the illicit market? Very possibly not. Encouraging a switch to legal channels and lower potency forms of consumption among this group may be more effective than a situation where the only higher potency products they can access are unregulated and illicitly sourced.

3. The cap eliminates potential product formats:

A 15% potency cap would also rule out many potential product formats if applied across the board, including:

High-quality hash (typically 30%+ THC)

Vapes (typically 80% THC)

Other concentrates such as shatter, which can reach 85%+ THC.

This is not a case of introducing these products to the country for the first time - while previously a small proportion of Europe’s illicit market, these products have grown in popularity and accessibility over the past decade, mirroring trends in adoption and innovation across North America.

Consumers will continue to access the higher potency products they desire regardless of legal confines. The opportunity we have is to ensure that they have the option to purchase safer versions of these products that incurs less risk due to quality assurance, recalls and accurately reported THC content.

4. Unintended consequences / Increasing risks of harm:

Product safety risks:

The 2019 US ‘vape crisis’ is a clear example of how illegal, unregulated cannabis products create more risk for consumers than legal higher potency cannabis. According to the CDC, over 2,800 hospitalisations and 68 deaths were caused by ‘e-cigarette, or vaping, product use-associated lung injury’ (EVALI), which is strongly linked to the use of the additive Vitamin E acetate in illicitly sourced THC vapes.

It is clear that prohibition has not stopped interest and uptake of these products in Europe given their relative ease of availability. Without legal access to these products, consumers will continue to source them from the illicit market without controls on ingredients and additives and no recall system.

Physical safety:

A restriction on legal concentrate formats would maintain the ongoing risks to physical safety presented by the illicit market for these products - factors which legalisation should be seeking to address.

Restrictions encourage production of extract-based products by illicit suppliers or at home by consumers. When involving the use of solvents like ethanol and butane, this presents a very real explosion and fire risk. They also:

Force consumers of these products to continue interacting with the illicit market, along with risks of exposure to potentially violent criminal groups.

Prevent consumers accessing more potent products for harm reduction purposes, including to reduce the frequency or quantity of product they are combusting.

Risk of dampening the rigour of Germany’s medical market:

With Germany’s medical scheme providing increasingly reliable and easier access to >15% THC flower, would we see a rise in consumers seeking ‘quasi-medical’ prescriptions to gain access?

Evidence from US states that have more lenient purchasing terms or limits for medical patients suggests this does occur, although the scale of such behaviour is difficult to estimate.

5. Food for thought

Where should the line be drawn between public health and personal autonomy?

Would proposals for caps on consumption of other risk-incurring products (eg. alcohol, sugar, red meats, extreme spicy foods) be received in the same way?

Do cannabis consumers need to be ‘protected’ by the government more than consumers of other legal drugs (eg. alcohol, tobacco, caffeine)?

How much is stigmatisation (of THC and ‘skunk’ in particular) a driver of proposed caps, rather than scientific evidence?

Should we be reintroducing policing by law enforcement for banned products into the cannabis equation?

Conclusion

A cap on THC content may be politically popular, and provide comfort to those who are sceptical about the impacts of legalising recreational cannabis. Polling commissioned by First Wednesdays for Recreational Europe revealed that 46% of the German public would support a cannabis market with limits on product potency. It could also be leveraged as a bargaining chip to get legalisation over the line, assuring legalisation opponents that a compromise position has been reached.

But swinging too far on caps is misguided. If a cap is going to be set for the German market, we strongly caution that 15% is too low to encourage heavy consumers to the legal market. This risks undermining the legalisation experiment, especially when plans for pricing are planned to mirror rather than significantly undercut the illicit market.

We hope that the highly-anticipated final position paper contains a better reflection of cannabis consumer and market realities, rather than public health ideals grounded in aspiration.